Dubai's real estate market continues to break record after record, but this does not mean that affordable, profitable investment opportunities have disappeared. For investors with budgets of less than AED 1 million, the best opportunities lie in emerging communities that combine high rental yields (ROI) with high-growth capital.

This guide highlights the top 5 areas where you will find the most value, stability and return on your budget in 2025.

Why Invest Under AED 1 Million?

Unlike the luxury segments (such as Downtown or Palm Jumeirah), the segment below AED 1 million caters to the growing middle class and young professionals, ensuring stable rental demand and high net returns. In this price segment, you mainly buy studios and one-bedroom apartments(1-bedroom units).

Top 5 Investment Areas Under AED 1 Million by 2025

The following areas combine a low entry price with strong, established or expected rental yields (ROI) of 6.5% to over 9.0%.

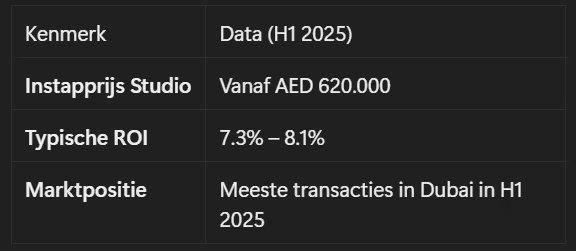

1. Jumeirah Village Circle (JVC).

JVC remains the absolute leader in transaction volume and the favorite of mid-market investors.

Why JVC. The neighborhood offers an excellent community feel with parks and schools, and rental demand is consistently high due to its relatively central location. Strong demand for smaller units (1-bedroom and studios) ensures rapid occupancy.

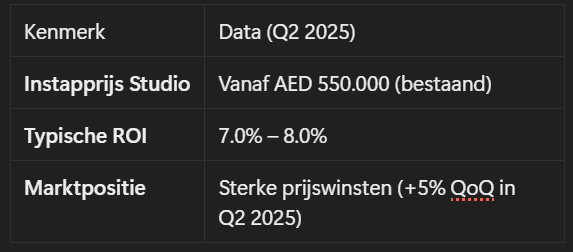

2. Dubai Silicon Oasis (DSO).

DSO is an integrated technology park that combines residential, commercial and academic zones. The market is driven by professionals and families.

Why DSO? The focus on technology and the "all-in-one" community model provide stability. Prices are favorable and proximity to businesses ensures a steady flow of tenants.

3. Dubai South

Dubai South is one of the most strategically emerging areas because of its proximity to Al Maktoum International Airport and the Expo City Dubai.

Why Dubai South. This area is considered a "hidden gem" with a lower entry level and huge capital growth potential. Future metro expansion and a focus on logistics and events will drive long-term demand.

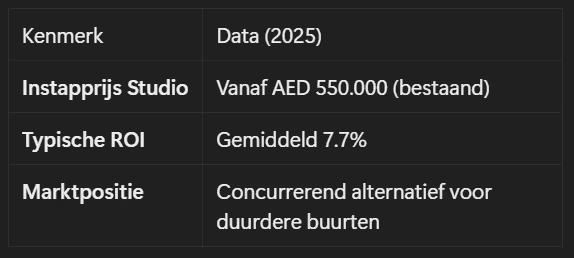

4. Dubai Sports City (DSC).

DSC offers a unique combination of an athletic lifestyle and affordable housing, with a mature infrastructure.

Why DSC? The presence of sports academies and events creates constant demand for both long-term and short-term rentals. With prices for one-bedroom apartments often still below AED 900,000, this is a safe choice for stable returns.

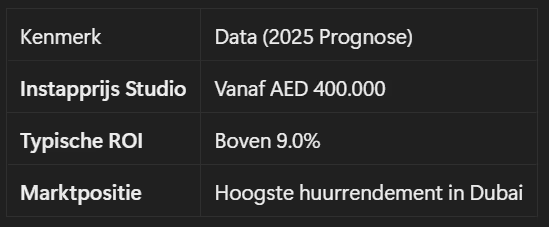

5. International City

International City is the most budget-friendly option on this list, ideal for investors seeking the highest absolute return on rent.

Why International City? Although capital growth here is more moderate than in JVC or Dubai South, entry prices are extremely low. This results in one of the highest gross rental yields in the entire emirate, which is attractive to investors seeking immediate cash flow.

Conclusion: Maximum Return under AED 1 Million

By 2025, Dubai offers plenty of opportunities for investors with budgets under AED 1 million. By focusing on studio or one-bedroom apartments in strategic, emerging areas such as JVC, Dubai South or DSO, you can benefit from both high returns and strong value growth.

Choosing off-plan projects in these areas often offers the lowest entry level and most flexible payment plans.

Contact Dubai-Property.com for a personalized analysis that fits your budget and risk profile.

Resource List

- Bayut / DLD Data Aggregators (2025): Current property listings and price data for various districts in Dubai, confirming entry prices below AED 1 million.

- Chesterton's MENA (Q1 2025 Report): Market report confirming volume leadership of Jumeirah Village Circle (JVC).

- Driven Properties / Property Finder (2025): Analysis of average ROI and market trends in DSO, JVC and International City.

- Footprint Real Estate (2025): Analysis of most profitable areas for investment and average rental yield (ROI).

- Primo Capital (H1 2025 Report): Report confirming average studio prices in Jumeirah Village Circle (JVC) and Mohammed Bin Rashid City (MBR City).

- ValuStrat Price Index (VPI) (Q2 2025): Data confirming price gains in DSO and overall market dynamics.

.svg)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)

.svg)

.svg)

.svg)